|

|

发表于 1-9-2018 06:23 AM

|

显示全部楼层

发表于 1-9-2018 06:23 AM

|

显示全部楼层

Date of change | 30 Aug 2018 | Name | DATUK SERI SYED ALI BIN TAN SRI SYED ABBAS ALHABSHEE | Age | 56 | Gender | Male | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Resignation | Reason | Pursue his personal interests | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | N/A | Working experience and occupation | N/A | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | Uzma Berhad - Direct interest: 111,450 Ordinary Shares (0.4%) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2018 05:08 AM

|

显示全部楼层

发表于 7-9-2018 05:08 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2018 06:04 AM 编辑

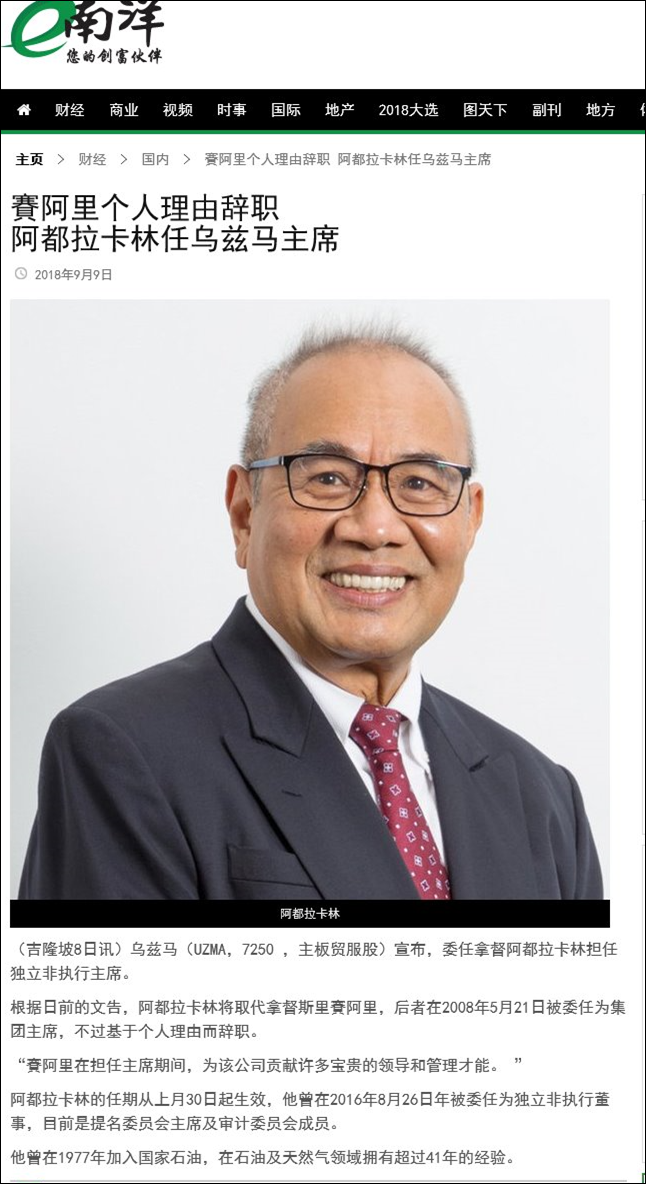

Type | Announcement | Subject | OTHERS | Description | Press Release: Appointment of New Chairman of Uzma Berhad | A copy of the press release in relation to the appointment of new Chairman of Uzma Berhad following the announcement made on 30 August 2018 is attached herewith, for the information of Bursa Securities Malaysia Berhad. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5904425

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-9-2018 04:43 AM

|

显示全部楼层

发表于 10-9-2018 04:43 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-9-2018 06:00 AM

|

显示全部楼层

发表于 27-9-2018 06:00 AM

|

显示全部楼层

Name | TENGGIRI TUAH SDN. BHD. | Address | 2765-C, Jalan Changkat Permata

Taman Permata

Kuala Lumpur

53300 Wilayah Persekutuan

Malaysia. | Company No. | 1184373-K | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares ("Shares") |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 18 Sep 2018 | 2,000,000 | Disposed | Direct Interest | Name of registered holder | Kenanga Nominees (Tempatan) Sdn. Bhd. Pledged Securities Account for Tenggiri Tuah Sdn. Bhd. | Address of registered holder | Level 15, Kenanga Tower 237 Jalan Tun Razak 50400 Kuala Lumpur | Description of "Others" Type of Transaction | | | 2 | 19 Sep 2018 | 1,572,500 | Disposed | Direct Interest | Name of registered holder | Kenanga Nominees (Tempatan) Sdn. Bhd. Pledged Securities Account for Tenggiri Tuah Sdn. Bhd. | Address of registered holder | Level 15, Kenanga Tower 237 Jalan Tun Razak 50400 Kuala Lumpur | Description of "Others" Type of Transaction | | | 3 | 20 Sep 2018 | 498,100 | Disposed | Direct Interest | Name of registered holder | Kenanga Nominees (Tempatan) Sdn. Bhd. Pledged Securities Account for Tenggiri Tuah Sdn. Bhd. | Address of registered holder | Level 15, Kenanga Tower 237 Jalan Tun Razak 50400 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of Shares | Nature of interest | Direct Interest | Direct (units) | 110,104,474 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 05:22 AM

|

显示全部楼层

发表于 18-10-2018 05:22 AM

|

显示全部楼层

Date of change | 17 Oct 2018 | Name | MR PETER ANGUS KNOWLES | Age | 61 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | To concentrate on his executive duties including the development of overseas business, the management of the Thai office and the management of Uzma Resource Solutions Sdn. Bhd. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information |

Working experience and occupation | N/A | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | Uzma Berhad-Direct interest: 242,000 Ordinary Shares (0.076%) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 07:56 AM

|

显示全部楼层

发表于 30-12-2018 07:56 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 87,526 | 99,289 | 87,526 | 99,289 | | 2 | Profit/(loss) before tax | 7,231 | 3,317 | 7,231 | 3,317 | | 3 | Profit/(loss) for the period | 7,878 | 6,578 | 7,878 | 6,578 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,240 | 6,330 | 7,240 | 6,330 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.26 | 2.11 | 2.26 | 2.11 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4600 | 1.4800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-1-2019 05:06 PM

|

显示全部楼层

发表于 3-1-2019 05:06 PM

|

显示全部楼层

http://www.enanyang.my/news/2019 ... %E6%9C%BA%E4%BC%9A/

乌兹马

浮现买入机会

2019年1月2日

分析:达证券

乌兹马(UZMA,7250,主板能源股)截至去年9月底首季,净利报7240万令吉,按年起14.38%。

D18注水设备(WIF)因泵和起重机有问题,导致使用率跌到30%至40%。但问题已解决,2019财年会恢复到95%使用率。

该公司旗下uzmAPRESS,有4项资产在2019财年首季,因新监管条例而无法使用。

行家建议:

乌兹马指出,D18注水设备未来料显著贡献,加上uzmAPRESS资产无法使用会向客户索赔,所以我们将上调两者的使用率预测。

D18注水设备的使用率,将于2019、20和21年,分别达75%、95%和95%;uzmAPRESS的资产则将于2019、20和21年,分别达60%、80%和80%使用率。

不过,纳入2018财年经审核业绩,我们会把2019、20和21年业绩预测,分别下修16.1%、8.7%和7.9%,目标价也根据2019年11倍本益比,下调到1.35令吉。

但我们相信,盈利疲弱只是一次性,市场反应过度,股价将会反弹

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2019 05:08 AM

|

显示全部楼层

发表于 26-1-2019 05:08 AM

|

显示全部楼层

Name | LEMBAGA TABUNG HAJI | Address | 201 Jalan Tun Razak

Peti Surat 11025

Kuala Lumpur

50400 Wilayah Persekutuan

Malaysia. | Company No. | ACT 535 (Tabung Haji Act,1995) | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares ("Shares") |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 28 Dec 2018 | 26,263,200 | Disposed | Direct Interest | Name of registered holder | Lembaga Tabung haji | Address of registered holder | 201, Jalan Tun Razak 50400 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Transfer of shares to URUSHARTA JAMAAH SDN. BHD. as a result of the restructuring exercise - 26,263,200 units | Nature of interest | Direct Interest | Direct (units) | 2,967,300 | Direct (%) |

| | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 2,967,300 | Date of notice | 28 Dec 2018 | Date notice received by Listed Issuer | 31 Dec 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 07:57 AM

|

显示全部楼层

发表于 9-2-2019 07:57 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | UZMA BERHAD ("UZMA" OR THE "COMPANY")PROPOSED ACQUISITION OF AN ADDITIONAL 15% EQUITY INTEREST IN SETEGAP VENTURES PETROLEUM SDN BHD ("PROPOSED ACQUISITION") | On behalf of the Board of Directors of Uzma (“Board”), Mercury Securities Sdn Bhd (“Mercury Securities”) wishes to announce that Tenggara Analisis Sdn Bhd (“Tenggara”), a wholly-owned subsidiary of Uzma, had on 29 January 2019 entered into a conditional share sale agreement (“SSA”) with Nasri Nasrun Ventures Sdn Bhd (“NNVSB” or the “Vendor”) to acquire 694,350 ordinary shares in Setegap Ventures Petroleum Sdn Bhd (“SVP”) (“Sale Shares”), representing 15% equity interest in SVP, for a cash consideration of RM36 million (“Purchase Consideration”) (“Proposed Acquisition”).

Please refer to the attachment for further details on the Proposed Acquisition.

This announcement is dated 29 January 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6053329

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2019 04:29 AM

|

显示全部楼层

发表于 12-2-2019 04:29 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | UZMA BERHAD ("UZMA" OR THE "COMPANY")PROPOSED ACQUISITION OF AN ADDITIONAL 15% EQUITY INTEREST IN SETEGAP VENTURES PETROLEUM SDN BHD ("PROPOSED ACQUISITION") | (For consistency, the abbreviations used throughout this announcement shall have the same meanings as defined in the announcement dated 29 January 2019 in relation to the Proposed Acquisition, where applicable, unless stated otherwise or defined herein.)

Reference is made to the earlier announcement dated 29 January 2019.

On behalf of the Board, Mercury Securities wishes to announce that the Proposed Acquisition has been completed on 31 January 2019 in accordance with the terms and conditions of the SSA.

This announcement is dated 31 January 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2019 09:46 PM

|

显示全部楼层

发表于 26-2-2019 09:46 PM

|

显示全部楼层

本帖最后由 icy97 于 27-2-2019 04:56 AM 编辑

| 7250 UZMA UZMA BHD | | Quarterly rpt on consolidated results for the financial period ended 31/12/2018 | | Quarter: | 2nd Quarter | | Financial Year End: | 30/06/2019 | | Report Status: | Unaudited | | Submitted By: | | | | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 31/12/2018 | 31/12/2017 | 31/12/2018 | 31/12/2017 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 105,577 | 110,400 | 193,103 | 209,689 | | 2 | Profit/Loss Before Tax | 9,285 | 6,510 | 16,516 | 9,827 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,175 | 6,360 | 15,415 | 12,690 | | 4 | Net Profit/Loss For The Period | 8,321 | 7,080 | 16,199 | 13,658 | | 5 | Basic Earnings/Loss Per Shares (sen) | 2.55 | 2.07 | 4.82 | 4.14 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 1.5300 | 1.4800 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-4-2019 04:21 AM

|

显示全部楼层

发表于 3-4-2019 04:21 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD -CONTRACT FOR THE PROVISION OF DIRECTIONAL DRILLING SERVICES FOR PT PERTAMINA HULU ENERGI ONSHORE NORTH WEST JAVA (PHE -ONWJ) CONTRACT NO: 4710002670 | 1. Introduction Uzma Berhad (“Uzma” or “Company”) is pleased to announce that it has obtained the approval on 13 March 2019 from PERTAMINA HULU ENERGI ONSHORE NORTH WEST JAVA (“PHE – ONJW”) to announce that PT Cougar Drilling Solutions Indonesia (“PT.CDSI”), a 95% sub-subsidiary of the Company (effective interest of 90.25%) had been awarded a contract for the Provision of Directional Drilling Services (“Contract”).

2. Salient terms The salient terms of the Contract are as follows:-

(a) The tenure of the Contract is two (2) years from February 25, 2019 to February 25, 2021 with an extension option which is subject to the approval of SKK MIGAS, an institution established by the Government of the Republic of Indonesia, tasked with managing upstream oil and gas business activities.

(b) The Contract does not constitute a commitment for any specific work. The execution of the Contract is depending on work orders to be issued to PT. CDSI from time to time at the discretion of PHE-ONWJ. As such, there is no firm value for the Contact. The Company will make the required announcement pursuant to the Bursa Malaysia Securities Berhad Main Market Listing Requirements as and when a material sum of work order is received under the Contract.

3. Financial effects The Contract will not have any effect on the share capital and shareholding structure of the Company. It is expected to contribute positively to the earnings of the Group and enhance net assets per share of the group for the financial year ending 30 June 2019 and onwards until the expiry of the Contract if work orders are issued to PT.CDSI.

4. Risks in relation to the Contract The Group foresees, amongst others, the risk factors affecting the Contract includes the delay in issuing work order. The execution of the contract is depending on work orders to be issued by PHE- ONWJ from time to time. It is the prerogative of PHE-ONWJ to decide the timing on the requirement of services. Hence, any delay in issuing work orders will lead to delay in revenue recognition.

5. Directors’ and Major Shareholders’ Interests None of the Directors and/or major shareholders and/or persons connected with the Directors and/or major shareholders of Uzma has any direct or indirect interest in the Contract.

6. Directors’ Statement The Board of Directors of the Company is of the opinion that the acceptance of the Contract is in the best interest of the Company.

This announcement is dated 14 March 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-4-2019 03:34 AM

|

显示全部楼层

发表于 5-4-2019 03:34 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD - CONTRACT FOR THE PROVISION OF ONSHORE HYDRAULIC WORKOVER SERVICES (340K) FOR PTTEP INTERNATIONAL LIMITED, PTTEP SIAM LIMITED AND PTTEP SP LIMITED. ("THE CLIENT") CONTRACT NO: THC18-5188 | 1. Introduction Uzma Berhad (“Uzma” or “Company”) is pleased to announce that it has obtained the approval on 18 March 2019 from the Client to announce that MMSVS Group Holdings Co., Ltd (“MMSVS”), a wholly-owned subsidiary of the Company had been awarded a contract for the Provision of Onshore Hydraulic Workover Services (340K) (“Contract”).

2. Salient terms The tenure of the Contract is three (3) years from 1st March, 2019 to 30th June 2022 with an option of an extension of a maximum period of One (1) year.

3. Financial effects The Contract will not have any effect on the share capital and shareholding structure of the Company. It is expected to contribute positively to the earnings of the Company and enhance net assets per share of the group for the financial year ending 30 June 2019 and onwards until the expiry of the Contract.

4. Risks in relation to the Contract The Group foresees, amongst others, the risk factors affecting the Contract includes project operational and execution risks, work schedules and delivery timelines.

5. Directors’ and Major Shareholders’ Interests None of the Directors and/or major shareholders and/or persons connected with the Directors and/or major shareholders of Uzma has any direct or indirect interest in the Contract.

6. Directors’ Statement The Board of Directors of the Company is of the opinion that the acceptance of the Contract is in the best interest of the Company.

This announcement is dated 19 March 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-7-2019 07:36 AM

|

显示全部楼层

发表于 4-7-2019 07:36 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 111,433 | 91,932 | 304,536 | 301,621 | | 2 | Profit/(loss) before tax | 5,599 | 2,369 | 22,115 | 12,196 | | 3 | Profit/(loss) for the period | 4,335 | 333 | 20,534 | 13,991 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,485 | -100 | 17,900 | 12,590 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.78 | -0.03 | 5.59 | 4.11 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5400 | 1.4800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-7-2019 11:29 PM

|

显示全部楼层

发表于 18-7-2019 11:29 PM

|

显示全部楼层

追风人 发表于 3-1-2019 05:06 PM

http://www.enanyang.my/news/20190102/%E4%B9%8C%E5%85%B9%E9%A9%AC-br-%E6%B5%AE%E7%8E%B0%E4%B9%B0%E5%85%A5%E6%9C%BA%E4%BC%9A/

乌兹马

浮现买入机会

2019年1月2日

分析:达证券

乌兹马(UZMA,7250 ...

RM0.675.........buy .gif) |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-7-2019 11:39 AM

|

显示全部楼层

发表于 24-7-2019 11:39 AM

|

显示全部楼层

进出几次都有小赚一点,现在等大红花,重仓在这个大红花,今年八月会增产,明年一月也会增产,希望明年五月会有惊喜,前提是油价要保持60每桶以上。

|

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2019 11:05 PM

|

显示全部楼层

发表于 28-7-2019 11:05 PM

|

显示全部楼层

RM0.665 吃不完 !!! |

|

|

|

|

|

|

|

|

|

|

|

发表于 4-8-2019 09:57 PM

|

显示全部楼层

发表于 4-8-2019 09:57 PM

|

显示全部楼层

RM0.62...... , 破0.6。。。再买。 , 破0.6。。。再买。.gif) |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2019 03:55 PM

|

显示全部楼层

发表于 6-8-2019 03:55 PM

|

显示全部楼层

RM 0.55。。。。。买!.gif) |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2019 10:35 PM

|

显示全部楼层

发表于 28-8-2019 10:35 PM

|

显示全部楼层

本帖最后由 icy97 于 29-8-2019 02:31 AM 编辑

| 7250 UZMA UZMA BHD | | Quarterly rpt on consolidated results for the financial period ended 30/06/2019 | | Quarter: | 4th Quarter | | Financial Year End: | 30/06/2019 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 30/06/2019 | 30/06/2018 | 30/06/2019 | 30/06/2018 |

| RM '000 | RM '000 | RM '000 | RM '000 | 1 | Revenue | 138,909 | 82,477 | 443,445 | 384,098 | 2 | Profit/Loss Before Tax | 20,827 | 2,070 | 42,942 | 14,266 | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,804 | 4,579 | 29,704 | 17,169 | 4 | Net Profit/Loss For The Period | 14,686 | 4,817 | 35,220 | 18,808 | 5 | Basic Earnings/Loss Per Shares (sen) | 3.69 | 1.48 | 9.28 | 5.54 | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 |

| |

| As At End of Current Quarter | As At Preceding Financial Year End | 7 | Net Assets Per Share (RM) |

| | 1.5000 | 1.4800 |

|

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|